1/2 Day Landlord Training Course – Legal Update 2023

½ Day Landlord Training Course – Legal Update 2023 Wednesday 16th August 2023 – 9am – 1pm Venue – Online If you are accredited this

½ Day Landlord Training Course – Legal Update 2023 Wednesday 16th August 2023 – 9am – 1pm Venue – Online If you are accredited this

Article by GoSimpleTax Register as a sole trader or set up a limited company? It’s a key question to answer when you decide to take

Article by GoSimpleTax Register as a sole trader or set up a limited company? It’s a key question to answer when you decide to take

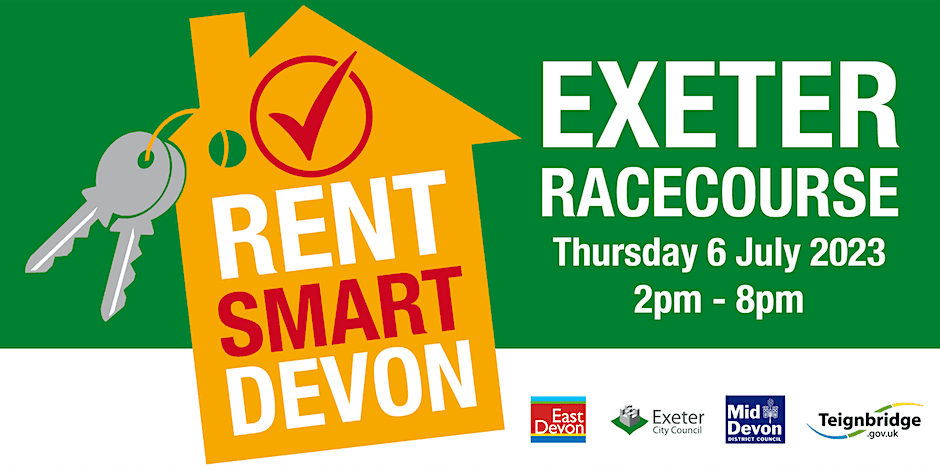

For tickets please visit; https://www.eventbrite.co.uk/e/rent-smart-devon-formerly-the-renting-minefield-tickets-558774588837?aff=ebdssbcategorybrowse SWLA will be there. Come and say Hi if you pass our stand!

For tickets please visit; https://www.eventbrite.co.uk/e/rent-smart-devon-formerly-the-renting-minefield-tickets-558774588837?aff=ebdssbcategorybrowse SWLA will be there. Come and say Hi if you pass our stand!

Article from Plymouth Job Centre Plus, DWP People of State Pension age may be entitled to Pension Credit even though they may have modest savings,

Article from Plymouth Job Centre Plus, DWP People of State Pension age may be entitled to Pension Credit even though they may have modest savings,

Information relating to the Renters (Reform) Bill which was introduced to Parliament on 17 May 2023 The Renters (Reform) Bill will deliver on the government’s commitment to

Information relating to the Renters (Reform) Bill which was introduced to Parliament on 17 May 2023 The Renters (Reform) Bill will deliver on the government’s commitment to

A Statement from the Department for Levelling Up, Housing and Communities Update on the Renters (Reform) Bill The Renters (Reform) Bill will deliver the government’s