Free – Mid Devon Landlord Networking Event – Wednesday 14th May 2025 – 4pm to 9pm – Collumpton

Hosted by Mid Devon District Council, their fourth event aimed directly at all local property landlords to be held at The Corn Barn, Cullompton. For those

Hosted by Mid Devon District Council, their fourth event aimed directly at all local property landlords to be held at The Corn Barn, Cullompton. For those

Article by Des Taylor – Landlord Licencing Specialist. Everything’s quiet. Your tenants are settled. No complaints. No chaos. No drama. You’ve been managing your HMOs

Letting agents need to meet new reporting obligations as part of the UK Financial Sanctions Regulations – with the new rules coming on 14 May.

Making Tax Digital is a Government initiative to modernise the tax system, by requiring businesses to keep and submit records of their property income and

SWLA members can now enjoy exclusive discounts of up to 10% off appliances and up to 5% off tech through Currys Business, a leading retailer

We are joining up with with the Managing Director of Ashley Taylors Legal – Martyn Taylor – to bring you a regular ‘Bitesize Webinar’ –

The Ministry of Justice will increase 171 court and tribunal fees to account for changes to the Consumer Price Index (CPI). The income generated from

All deals can be viewed here; TradePoint | Trade Building Merchants & Timber Supplies

Dave Ryland and Councillor Penberthy visited the SWLA office as part of their bi-monthly check in and information gathering regarding the Private Rented Sector. Such

We are excited to announce the launch of our new discounted tenant referencing service in partnership with top-tier referencing agency, FLS. Our service, accessible through

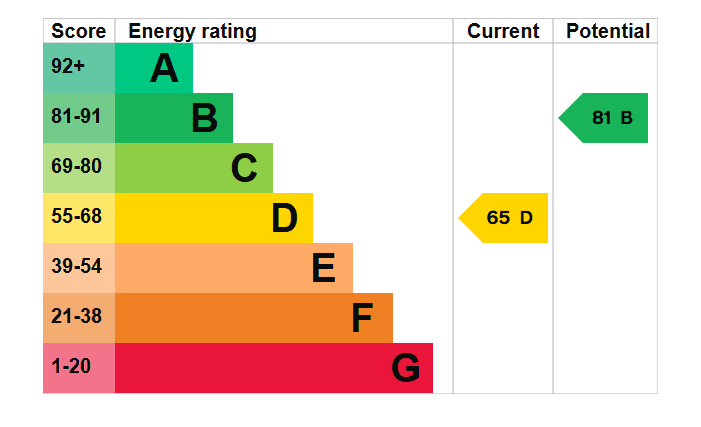

The government has launched a consultation on Improving the Energy Performance of Privately Rented Homes. The responses will shape the new approach for driving improvements.

Company No: 03670683 Registered Address: SWLA, 30 Dale Road, Plymouth, PL4 6PD – Website by GSL Media

Copyright © 2023 SWLA. All rights reserved